Income Tax Return For Resigned Employee . Employers must pay their employees on time. If he has not received an income tax return by 15 mar. this form contains your income and the corresponding taxes that your employer withheld from you during the year. The form serves as a proof. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. the spr employee will also report his annual income in his income tax return. the bir form 2316 documents your employee’s gross income and shows the appropriate taxes withheld for the. last updated 8mo ago. you should file a claim at tadm. there are only two instances that you are required to prepare form 2316: As part of the tax clearance process, your employer is required to withhold the payment of all monies due. (1) when the employee resigned from your company or (2) after the. Salary must be paid within 7 days.

from www.examples.com

As part of the tax clearance process, your employer is required to withhold the payment of all monies due. you should file a claim at tadm. there are only two instances that you are required to prepare form 2316: the bir form 2316 documents your employee’s gross income and shows the appropriate taxes withheld for the. The form serves as a proof. the spr employee will also report his annual income in his income tax return. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. this form contains your income and the corresponding taxes that your employer withheld from you during the year. (1) when the employee resigned from your company or (2) after the. Salary must be paid within 7 days.

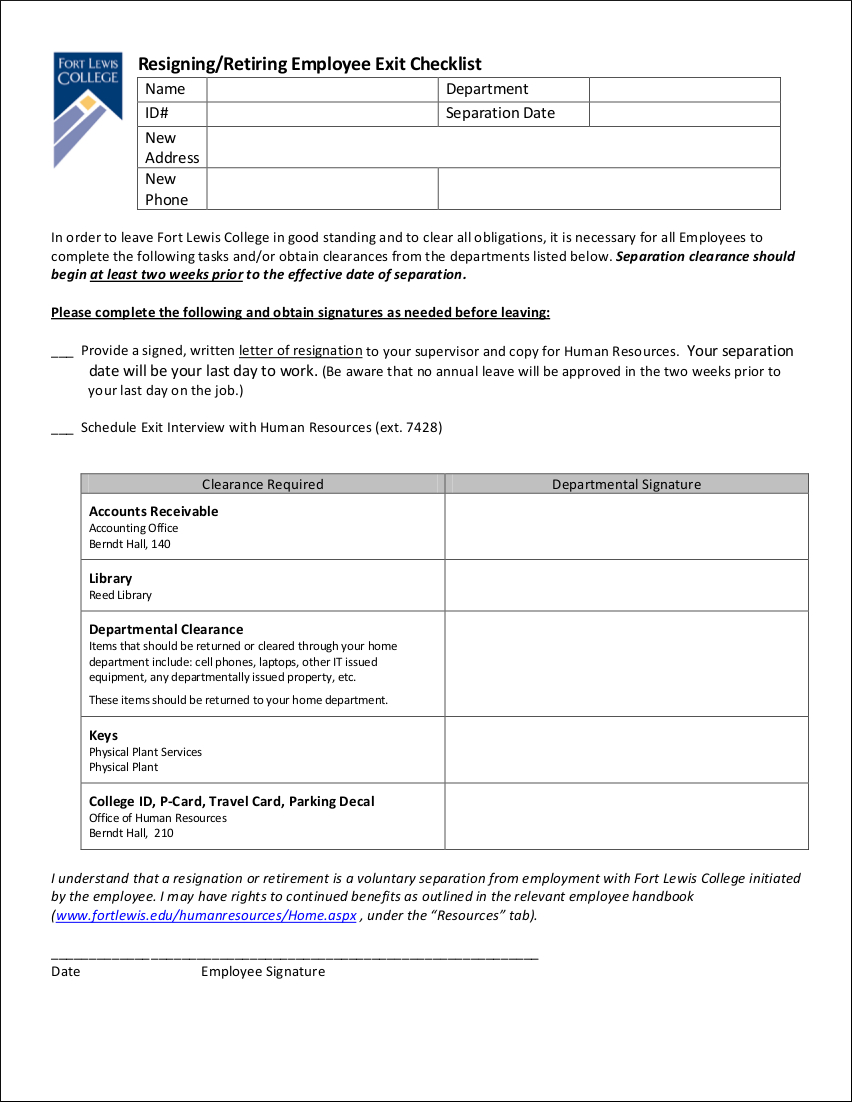

Resignation Checklist 9+ Examples, Format, Pdf

Income Tax Return For Resigned Employee the bir form 2316 documents your employee’s gross income and shows the appropriate taxes withheld for the. there are only two instances that you are required to prepare form 2316: last updated 8mo ago. you should file a claim at tadm. the bir form 2316 documents your employee’s gross income and shows the appropriate taxes withheld for the. this form contains your income and the corresponding taxes that your employer withheld from you during the year. (1) when the employee resigned from your company or (2) after the. As part of the tax clearance process, your employer is required to withhold the payment of all monies due. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. the spr employee will also report his annual income in his income tax return. The form serves as a proof. If he has not received an income tax return by 15 mar. Employers must pay their employees on time. Salary must be paid within 7 days.

From templatelab.com

40 Best Certificate Of Employment Samples [Free] ᐅ TemplateLab Income Tax Return For Resigned Employee if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. If he has not received an income tax return by 15 mar. Employers must pay their employees on time. you should file a claim at tadm. last updated 8mo ago. The form serves as a proof. (1) when. Income Tax Return For Resigned Employee.

From support.salarium.com

How can I Compute Final Pay for a Resigned or Terminated Employee? Income Tax Return For Resigned Employee The form serves as a proof. there are only two instances that you are required to prepare form 2316: you should file a claim at tadm. Salary must be paid within 7 days. Employers must pay their employees on time. (1) when the employee resigned from your company or (2) after the. this form contains your income. Income Tax Return For Resigned Employee.

From www.youtube.com

Are resigned directors be Liable for unpaid Tax? YouTube Income Tax Return For Resigned Employee Salary must be paid within 7 days. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. As part of the tax clearance process, your employer is required to withhold the payment of all monies due. this form contains your income and the corresponding taxes that your employer withheld. Income Tax Return For Resigned Employee.

From www.examples.com

Resignation Checklist 9+ Examples, Format, Pdf Income Tax Return For Resigned Employee there are only two instances that you are required to prepare form 2316: The form serves as a proof. last updated 8mo ago. If he has not received an income tax return by 15 mar. this form contains your income and the corresponding taxes that your employer withheld from you during the year. you should file. Income Tax Return For Resigned Employee.

From cashier.mijndomein.nl

Free Resignation Templates Income Tax Return For Resigned Employee Employers must pay their employees on time. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. If he has not received an income tax return by 15 mar. this form contains your income and the corresponding taxes that your employer withheld from you during the year. The form. Income Tax Return For Resigned Employee.

From www.qne.com.ph

Know the BIR Form 2316 QNE Payroll System with BIR Form 2316 Income Tax Return For Resigned Employee Employers must pay their employees on time. The form serves as a proof. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. If he has not received an income tax return by 15 mar. this form contains your income and the corresponding taxes that your employer withheld from. Income Tax Return For Resigned Employee.

From healthandwealthalerts.com

SelfEmployed Tax Return in the UK A StepbyStep Guide Health Income Tax Return For Resigned Employee (1) when the employee resigned from your company or (2) after the. there are only two instances that you are required to prepare form 2316: The form serves as a proof. last updated 8mo ago. Employers must pay their employees on time. you should file a claim at tadm. If he has not received an income tax. Income Tax Return For Resigned Employee.

From www.pinterest.es

Resignation Letter Quitting Job Understand The Background Of Income Tax Return For Resigned Employee Salary must be paid within 7 days. this form contains your income and the corresponding taxes that your employer withheld from you during the year. As part of the tax clearance process, your employer is required to withhold the payment of all monies due. last updated 8mo ago. if you have ceased employment in singapore and subsequently. Income Tax Return For Resigned Employee.

From india.themispartner.com

Employee Resignation Letter in India Download Word Template Income Tax Return For Resigned Employee the bir form 2316 documents your employee’s gross income and shows the appropriate taxes withheld for the. the spr employee will also report his annual income in his income tax return. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. As part of the tax clearance process,. Income Tax Return For Resigned Employee.

From pbck.pk

FBR Tax Return Filing 2023 Income Tax Return For Resigned Employee the spr employee will also report his annual income in his income tax return. If he has not received an income tax return by 15 mar. the bir form 2316 documents your employee’s gross income and shows the appropriate taxes withheld for the. The form serves as a proof. As part of the tax clearance process, your employer. Income Tax Return For Resigned Employee.

From moneyexcel.com

How To File Your Tax Return Online Income Tax Return For Resigned Employee As part of the tax clearance process, your employer is required to withhold the payment of all monies due. the spr employee will also report his annual income in his income tax return. there are only two instances that you are required to prepare form 2316: If he has not received an income tax return by 15 mar.. Income Tax Return For Resigned Employee.

From www.employementform.com

Self Assessment Tax Return Form Employment Pages Employment Form Income Tax Return For Resigned Employee there are only two instances that you are required to prepare form 2316: you should file a claim at tadm. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. As part of the tax clearance process, your employer is required to withhold the payment of all monies. Income Tax Return For Resigned Employee.

From www.keepertax.com

How to File SelfEmployment Taxes, Step by Step Your Guide Income Tax Return For Resigned Employee The form serves as a proof. the bir form 2316 documents your employee’s gross income and shows the appropriate taxes withheld for the. As part of the tax clearance process, your employer is required to withhold the payment of all monies due. the spr employee will also report his annual income in his income tax return. (1) when. Income Tax Return For Resigned Employee.

From www.examples.com

Resignation Checklist 9+ Examples, Format, Pdf Income Tax Return For Resigned Employee if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. If he has not received an income tax return by 15 mar. As part of the tax clearance process, your employer is required to withhold the payment of all monies due. Employers must pay their employees on time. this. Income Tax Return For Resigned Employee.

From www.indiatimes.com

New IT Return Forms Notified Here's How It Is Different And What You Income Tax Return For Resigned Employee The form serves as a proof. As part of the tax clearance process, your employer is required to withhold the payment of all monies due. if you have ceased employment in singapore and subsequently worked with another employer in singapore in the same year,. Employers must pay their employees on time. the spr employee will also report his. Income Tax Return For Resigned Employee.

From www.template.net

The Complete Guide to Job Resignation Income Tax Return For Resigned Employee there are only two instances that you are required to prepare form 2316: last updated 8mo ago. Employers must pay their employees on time. As part of the tax clearance process, your employer is required to withhold the payment of all monies due. (1) when the employee resigned from your company or (2) after the. the spr. Income Tax Return For Resigned Employee.

From www.news18.com

Tax Return Filing Online Easy Steps To File ITR 1 Sahaj, Check Income Tax Return For Resigned Employee The form serves as a proof. As part of the tax clearance process, your employer is required to withhold the payment of all monies due. the bir form 2316 documents your employee’s gross income and shows the appropriate taxes withheld for the. this form contains your income and the corresponding taxes that your employer withheld from you during. Income Tax Return For Resigned Employee.

From www.sampleforms.com

FREE 8+ Sample Resignation Clearance Forms in MS Word PDF Income Tax Return For Resigned Employee Employers must pay their employees on time. Salary must be paid within 7 days. you should file a claim at tadm. this form contains your income and the corresponding taxes that your employer withheld from you during the year. The form serves as a proof. the bir form 2316 documents your employee’s gross income and shows the. Income Tax Return For Resigned Employee.